Senior Citizens' Investment Guide: Avoiding Financial Pitfalls

As living standards improve and life expectancy increases, the quality of life after retirement has become a significant concern. Ensuring that retirement funds retain their value and grow has become a critical issue for many seniors.

Why Do Seniors Need to Invest?

•Inflation: Rising prices can erode the purchasing power of money. Without investing, the real value of retirement funds may decrease over time.

•Improved Quality of Life: Investment returns can provide additional income for seniors, enhancing their quality of life.

•Emergency Preparedness: Investments can provide an emergency fund to handle unexpected medical expenses or other unforeseen costs.

Investment Principles for Seniors

•Safety First: Seniors typically have a lower risk tolerance, so prioritizing safe investments is essential.

•Moderate Liquidity: Considering that seniors may need access to their funds at any time, investments should offer a certain degree of liquidity.

•Stable Returns: Seniors should focus on investments that provide steady returns over the long term.

•Professional Guidance: Seniors can benefit from seeking help from financial advisors to develop a suitable investment plan.

Investment Products Suitable for Seniors

•Bank Deposits: High safety and strong liquidity make them ideal for risk-averse seniors.

•Government Bonds: Low risk with stable returns, suitable for long-term investment.

•Money Market Funds: These offer higher liquidity and slightly better returns than bank deposits.

•Certain Bond Funds: Lower risk with relatively stable returns.

•Annuities: These serve as long-term savings and investment tools and may offer tax benefits.

Case Study:

Mrs. Wang, age 60, receives a monthly pension of $5,000. She hopes to enhance her retirement life through investments but is unwilling to take on significant risks.

Investment Goals:

•Preserve and Grow Wealth: She wants to ensure that the purchasing power of her pension does not significantly diminish over time and ideally sees some growth.

•Stable Income: She aims to obtain a steady income from her investments each month to supplement her pension.

•Risk Control: Given her age, Mrs. Wang has a low-risk tolerance and prefers a stable investment portfolio.

Investment Advice:

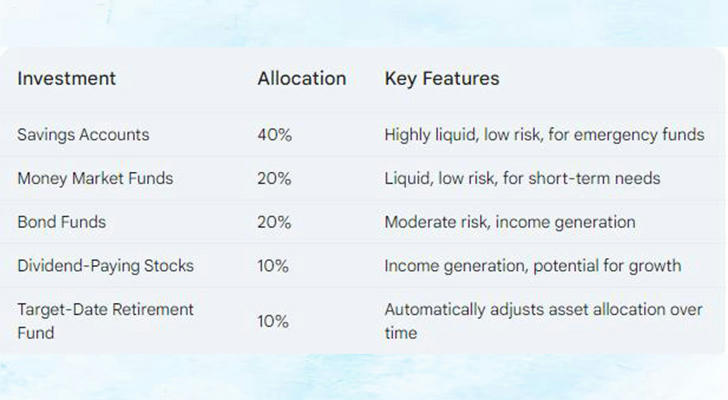

Considering Mrs. Wang’s risk preferences and investment goals, the following investment portfolio can be recommended.

Important Considerations for Senior Investors

•Invest Within Your Means: The investment amount should not be too large to avoid affecting your quality of life.

•Diversify Investments: Don’t put all your money into one product to spread the risk.

•Hold for the Long Term: Investments should be made with a long-term perspective, avoiding frequent trading.

•Beware of Scams: Seniors are often targeted by scammers. Always be vigilant and choose reputable financial institutions when investing.

Frequently Asked Questions

•Is the stock market suitable for seniors? The stock market is volatile and high-risk, making it unsuitable for seniors with low-risk tolerance.

•How should seniors choose financial products? Seniors should consult with a bank’s financial advisor or a professional financial planner to select the appropriate products based on their individual circumstances.

•How can seniors manage investment risks? Opt for low-risk investment products, diversify your portfolio, and regularly assess your investment strategy.

Conclusion

Investing retirement funds is a long-term and vital task that requires careful consideration. With proper planning and investment, seniors can preserve and grow their wealth, improving their quality of life.

Reminder: Investing involves risks, so make choices cautiously. It is advisable to consult with a professional financial advisor before making any investment decisions.